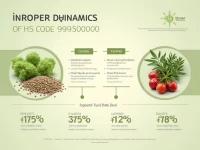

HS Code 0909500000 Dill Seeds and Juniper Berries Market Analysis

This analysis delves into cumin and juniper berries under the HS code 0909500000, highlighting their zero export tariff and relevant market potential. It aims to provide decision-making guidance for importers and exporters, thereby promoting trade efficiency.